A Utopian Dreamer is one who thinks we can create “Heaven on Earth” by having the Government screw the Hell out of the people 🙂 – Dr. Society

The Fairest Tax is one that is not levied directly on people, but rather an indirect excise tax on transactions, which is of equal rate to all, with no exemptions, and which funds the government from the bottom up (so that the top level does not control the lower levels by controlling their funds).

Taxation of wealth, in the form of income, property or estate, to support the government is a moral hazard (the moment tax from one person or group is used to benefit another, it become theft), gives incentive to avoidance and fraud and is against the founding principles of the Constitution which prohibited a direct tax on the people. Direct tax makes an end run around the states, fills the coffers of the Federal Government at the expense of the State, creates too much top down control due to all funds going directly to the top and the progressive tax rate reduces incentives for people to increase their incomes and treats people unequally under the law.

Only an amendment that broke the constitution with the support of a Politically intimidated supreme court allows this theft to be “legal”. Income tax requires an invasion of privacy, opening up private papers to the government, it steals the very life and liberty of the people in the time it takes to assemble the paper work, to comply with the wealth taxes. Tax exemptions and subsidies control the life of people, how they save, how they invest and even influences where they live.

With a direct tax, in principle, the government owns all of your income, property and wealth. Do you own the tax they currently take? You might have temporary possession but you have to yield it to the government. With salary withholding, you don’t even get temporary possession. Follow the logic. There is no limit on the tax rate the Federal Government can impose on what you legitimately earned. FDR was willing to impose a 100% tax. If the government can take everything and you can’t refuse, then you effectively don’t own anything. Rather, the government is granting you the privilege of keeping some of what you earn. That’s why they say you are stealing from the government is you don’t pay taxes. They own it. Not only do they own your wealth, they own the life and liberty, time, labor and resources that you invested in your earnings. They own YOU! You are a slave or at best a share-cropper.

Instead the 16th Amendment should be repealed and the Federal and State governments should be financed solely by an equal rate excise tax on transactions such as retail sales. At least you have control over when and how much tax you pay, based on your purchases. Can’t afford the tax this year, buying that TV set, couch or new car next year instead. The people can refuse to buy any products if the tax is too high. The infrastructure is already in place., Tracking public transactions does not violate privacy or influence the market or people’s lives. Products that come from foreign sources, not directed to a re-seller, can be taxed upon arrival into the USA, based on who is receiving the product.

It is intrinsically progressive. The rich buy more and pay more tax. The very poor do not pay taxes.

To help the poor, no consumption tax would effectively be collected on purchases up to the poverty level, as set by Congress. Every person living in the US would get a check (a pre-bate) to cover paying the consumption/sales tax. For example, if the poverty level is $25,000 and the flat sales tax is 20%, then everyone gets a check for $5,000 which pays for the 20% tax on the first $25,000 of purchases.

The 16th amendment would be repealed, making income tax unconstitutional, as it was before that amendment, and the IRS would be eliminated.

It would end all lobbying for special tax exemptions and the control the Federal government exerts through those exemptions.

The Fair Tax is an idea in the right direction, but is not comprehensive enough.

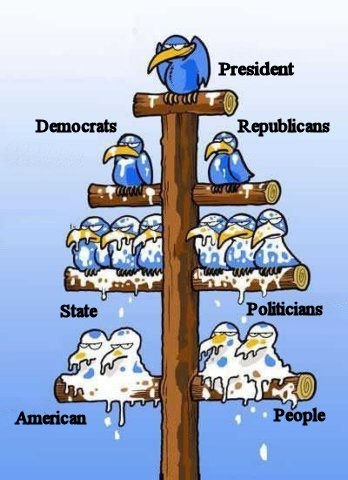

As long as the Federal government receives all the proceeds of the Consumption tax, the Federal Government still retains control of the States and the people because it can give or deny funding to them. Lobbying for special privileges, pork and corruption would continue.

The Fair tax would eliminate all taxes from business, income, capital gains, estate, property, gas, liquor etc. on the federal level and replace them with one equal/flat rate retail consumption/sales tax across the nation with no exemptions. Good.

However, The Fair Tax also does not change the way States and local government collects revenue; – through income, property, wealth and estate tax which is theft of property ownership/stewardship.

The Fairest Tax would be one that applies to how ALL levels of government are funded and would fund from the bottom up. The community, town, borough, parish and State of the Purchaser before the Federal Government.

ALL taxes right down to the State and local level would be replaced by one, flat rate, tax on all consumption of goods and services. Businesses or people that sell a product or service would not pay this tax on purchases that are to be included in the end product (no value added tax) because they are not the end consumer. The consumption tax would be collected when the product or service is purchased. Non-profits and the Federal Government which produce nothing for purchase must pay the tax for goods and services they consume. Tax collected from the Government is distributed to all States equally (or by representation).

The flat rate purchase tax would be collected by the credit/debit card companies, PayPal or (especially if a purchase if made in cash), by the merchant or service provider. Internet merchants located within the United States would be required to collect sales tax according to delivery zip code. Sales tax not collected and paid by Internet sites outside the USA will be collected on arrival of the merchandise to the United states or billed to the purchaser. To ensure privacy, if no bill of sale is included a flat fee will be charged.

The tax would be sent to the State where the purchaser (person or business entity) lives (using zip code) or where the merchandise is delivered, not the point of sale (to prevent richer communities, or states, from hogging the stores and the tax revenue), to be distributed by the State for the support of government in the following order: first to the Community where the purchaser (person or entity) resides, then their Town, Borough, County/Parish and finally the State and the Federal government (apportioned according to the representation of the state in the federal government as per the Constitution).

The communities where people or entities, who spend more, live in will get more revenue due to the greater amount of purchases by their residents. What are the consequences? With that revenue they can build their community, fight crime, buy better fire and security equipment, hire the best teachers, fix roads up, provide luxuries and whatever the community government deems to be correct. The community can also help other poorer communities, especially those that border on theirs. Property values would go up if the surrounding communities are improved. Fighting crime in adjoining neighborhoods is prevention of crime in yours. Further, the next level of government up (Borough, Parish, County etc.) will also have more money. If there are poorer communities within that next level, that level can allocate more money to the poorer communities if it so chooses. Common improvements at the higher level also benefit the poorer communities.

Perhaps communities will want the big spenders and be discriminatory to the poor or the retired. However, the revenue from the sale of a home in their town to a new resident would go to the community where the purchaser resided, before they purchased the house. Since the poor and middle spenders are more likely to move up, the poorer community benefits when their residents move out.

All funding and control from above such as Federal funding of States and the States funding of their cities and towns, would end. Lower level governments would no longer be slaves begging for and being controlled by funding from above.

Alternatively, In a small town or community it is feasible to account and bill for services for each family or person rather than have an imprecise tax. The County, Borough, Parish and other divisions up to the State can bill for services rendered to their respective sub-divisions (factoring in the amount they pay to the level above them).

All services should be brought down to the local level when possible. No social services other than at the local level where there is a face to face and community relationship between the giver, the provider and the recipient to make sure the recipient isn’t committing fraud and to help, educate or kick their butts back into self-sufficiency.

Then we could have the federal government transition back to handling only the tasks explicitly specified in the Constitution. Any other powers usurped by the Federal government under the misinterpretation of “General welfare” clause, in the Constitution, such as charity, education and social services would be handled and funded at the local level.